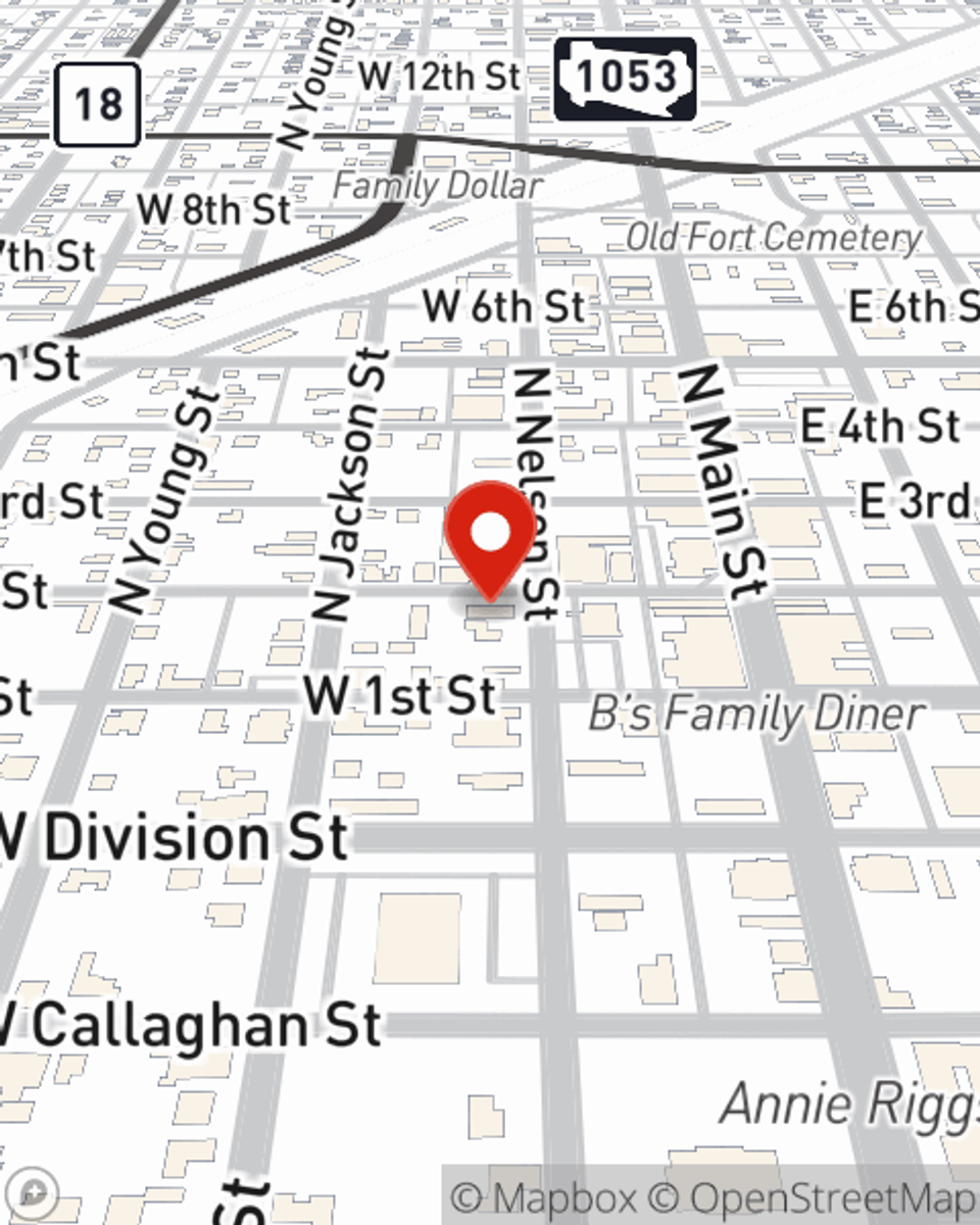

Homeowners Insurance in and around Fort Stockton

Homeowners of Fort Stockton, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Alpine, TX

- Presidio, TX

- Fort Davis, TX

- Marfa, TX

Welcome Home, With State Farm Insurance

It's so good to be home, especially when your home is insured by State Farm. You never have to be afraid of the unanticipated with this great insurance.

Homeowners of Fort Stockton, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Fort Stockton Choose State Farm

Preparing for life's troubles is made easy with State Farm. Here you can personalize your policy or file a claim with the help of agent Kessia Ledesma. Kessia Ledesma will make sure you get the attentive, great care that you and your home needs.

Fort Stockton, TX, it's time to open the door to great insurance. State Farm agent Kessia Ledesma is here to assist you in getting started. Get in touch today!

Have More Questions About Homeowners Insurance?

Call Kessia at (432) 336-8575 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Kessia Ledesma

State Farm® Insurance AgentSimple Insights®

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.